Alaska State Tax Guide

State tax registration guide for Alaska.

Need to register taxes in another state? Review the State Tax Guide section in our Tax Services Toolkit.

REQUIRED REGISTRATIONS

-

Unemployment Insurance: Alaska Department of Labor and Workforce Development

-

Income Tax Withholding: N/A (no state income tax)

REQUIRED INFORMATION

-

SUI ID # (format: XXXXXXXX)

-

Current year SUI rate

-

Geographic Code (format: XX)

-

Occupational Code (format: XXXXXX)

Note: Based on your company's details, your Namely Payroll setup may include several Alaska Tax Codes. Alaska Employee Unemployment uses the same ID as Alaska Unemployment tax.

REGISTERING FOR UNEMPLOYMENT INSURANCE

If you're a new employer in Alaska, you'll need to register with the Department of Labor and Workforce Development here, in order to obtain your account number.

TIP:

Future-date registration is possible for this state's unemployment insurance!

Once registered, you will receive an Unemployment Account Number (UI) (called “total contribution rate”) and Unemployment Rate (%) which you will need to enter into Namely Payroll under Company > Tax (UI tax). If your account number is 5 or 6 digits, please add leading zeros to it.

Businesses that have run payroll in Alaska previously can find their account number on the Contribution Rate Notice or Quarterly Contribution Report received from the Alaska Department of Labor and Workforce Development or by calling the number below.

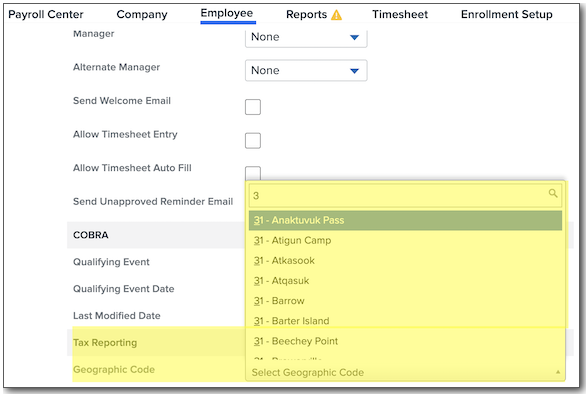

Employers must provide a Geographic Code for any employees subject to Alaska’s unemployment insurance tax.

To review and/or add this information for any employee subject to AK UI:

-

Use Alaska’s Geographic Code lookup website to find appropriate codes for each employee based on their primary work location.

-

Go to Payroll > Employee > search for the employee’s Payroll profile > General.

-

You can also filter your employee list to only display employees who work in the state of Alaska.

-

-

Under Tax Reporting, enter or select the correct Geographic Code.

-

Click Save.

For additional information on registering for taxes, read Employment Tax Registration Overview.

POWER OF ATTORNEY FORM

Please note, Namely does not require a Power of Attorney for this state at this time. It is not required to file or remit payments on your behalf. If one is needed to resolve a tax matter, the tax notice team will request one from you at that time.

If a Power of Attorney is requested from you, you should email completed copies of the forms namelyPOA@Namely.com with the CID in the subject line for processing. We will update our system and maintain a copy of each form for record-keeping purposes

For additional information on Power of Attorney, read Completing the Power of Attorney Package.

PAYROLL + TAX FACTS

Refer to this document to have more information:2022-2023 Federal and State: Payroll and Tax Fact Sheet.